Victor Shih, currently an assistant professor of political science at Northwestern University, keeps a blog at which he addresses issues related to Chinese politics. The blog deals mainly with topics related to Chinese political economy (an increasingly important topic as the rate for your car/home/student loan is intimately connected to the amount of US Treasury bonds purchased by the Chinese Central Bank) and elite politics in China.

Category: Markets

Washington Post Reports that China no longer as Attractive an “Outsourcing” Target

The average person may not know the difference between “offshoring” and “outsourcing”, but one would think that it would be a condition of employment for someone who writes for the business section of the Washington Post. In an otherwise informative story on the decreasing attractiveness of China as an “outsourcing” location for US companies, we are witness to another example of a member of the traditional media seemingly uninformed of basic facts.

Outsourcing is simply the idea that a company chooses to have another company produce a good or service rather than produce that same good or service in-house. Outsourcing has been happening for a long time, and an example is when the Ford Motor Company decided that it would be better to use their productive capacity to produce engines, and outsource the task of making tires to a different company rather than make tires itself. This helped increase productivity by allowing Ford to concentrate on the making of engines, and have the other company (Goodyear, Bridgestone) focus on making better tires.

Offshoring simply means sending work beyond one’s national boundaries. Notice that not all offshoring is also outsourcing. In fact, I have previously read (but I can’t find the source) that most offshoring is, in fact, not also outsourcing. How can this be? Well, what happens when General Motors decides to close down a car factory in Flint and make begin producing vehicles in Windsor, Ontario instead? That production (and the jobs accopanying it) has been offshored (moved to a different country–Canada) but it hasn’t been outsourced, since GM is still producing the vehicles. Here’s a little chart that will help you understand the difference.

As for the article itself, it demonstrates that rising fuel costs have increased the cost of shipping to such an extent that the potential savings for a US company of producing in China are completely eliminated. One such company has repatriated production to the US from China (I suppose that’s called “onshoring”?) We read:

SHANGHAI — Harry Kazazian built his business on sleeping bags that are made in China and shipped across the ocean to the United States, but he realized recently that the math doesn’t work anymore.

With fuel prices at record highs, the cost of sending a standard 40-foot container of goods has gone from $3,000 in 2000 to about $8,000 today, squeezing profit.

So this summer Kazazian, chief executive of Exxel Outdoors, a Los Angeles-based maker of recreational equipment, did something radical: He moved the manufacturing back to Haleyville, Ala.

Soaring energy costs, the falling dollar and inflation are cutting into what U.S. manufacturers call the “China price”– the 40 to 50 percent cost advantage once offered by Chinese producers.

The export model that has powered China and other Asian countries for three decades will be compromised if fuel prices continue to rise, said Stephen Jen, a managing director for Morgan Stanley.

“Globalization has gone a little bit too far. It has overshot,” Jen said. “We’re not saying Asia is going to crumble, but we are saying Asia enjoyed extraordinary conditions in the past. Now the conditions are changing very quickly because of the energy shock, and Asia is coming under pressure.”

The ripple effects have been far-reaching. The trade imbalance between the United States and China — a source of political tension for years — is beginning to right itself as Chinese exports fall and U.S. exports rise. Global trade routes are being transformed, suggesting a possible return to a less integrated world economy.

How Your Mortgage Payment Funds Norwegian Town’s Workforce

On the first day of class, I made the argument that in order for me to fulfill my pedagogical goals this semester, I need your help. I needed you to understand that what you choose to do (or not to do) in the classroom (and on your blog) will affect not only the grade you receive and how much you learn in this course, but will also affect the learning and grades of your peers sitting beside you in class. We live in societies, in which we all–to a greater or lesser extent–have an effect on those with whom we come into contact, with whom we share work places, roads, stadia, and class rooms. We all understand that if your neighbor’s house is unkempt and the lawn is overgrown, this will have a detrimental effect on your own property values.

Since we’re talking about property and the effects of social interaction, how is it that the town of Narvik, Norway (on the Arctic Circle) has had to miss a payroll for its municipal workers as the result of residents of Stockton (CA), Miami (FL), Flint(MI), and Worcester (MA), no longer being able to pay their residential mortgages? This New York Times article helps explain, and so does Jon Stewart’s guest, CNN Personal Finance editor Gerri Willis:

— At this time of year, the sun does not rise at all this far north of the Arctic Circle. But Karen Margrethe Kuvaas says she has not been able to sleep well for days.

What is keeping her awake are the far-reaching ripple effects of the troubled housing market in sunny Florida, California and other parts of the United States.

Ms. Kuvaas is the mayor of Narvik, a remote seaport where the season’s perpetual gloom deepened even further in recent days after news that the town — along with three other Norwegian municipalities — had lost about $64 million, and potentially much more, in complex securities investments that went sour.

”I think about it every minute,” Ms. Kuvaas, 60, said in an interview, her manner polite but harried. ”Because of this, we can’t focus on things that matter, like schools or care for the elderly.”

Norway’s unlucky towns are the latest victims — and perhaps the least likely ones so far — of the credit crisis that began last summer in the American subprime mortgage market and has spread to the farthest reaches of the world, causing untold losses and sowing fears about the global economy.

Where all the bad debt ended up remains something of a mystery, but to those hit by the collateral damage, it hardly matters.

Tiny specks on the map, these Norwegian towns are links in a chain of misery that stretches from insolvent homeowners in California to the state treasury of Maine, and from regional banks in Germany to the mightiest names on Wall Street. Citigroup, among the hardest hit, created the investments bought by the towns through a Norwegian broker…

…But Narvik has $34.5 million in a second Citigroup-devised investment, known as a collateralized debt obligation, which has also lost value as a result of the broader market turmoil. The town stands to lose at least some of that money, too.

Those investments represent a quarter of Narvik’s annual budget of $163 million, and covering the losses would necessitate taking out a long-term loan, which the town could only pay off by cutting back on services.

”You can calculate this in terms of places for schoolchildren or help for the elderly,” said Mr. Hermansen, a soft-spoken man who sat in his office in near-darkness, the lights switched off…

…In 2004, Narvik and a number of other towns took out a large loan, using future energy revenue as collateral. They invested the money, through Terra Securities, in the Citigroup debt vehicle, which offered a better return than traditional investments. In June 2007, as the subprime problems were brewing, Narvik shifted some money from that investment into an even more complex one, again through Terra Securities.

Do read the whole thing as it is interesting. Note, however, the really key part of the whole story in bold in the paragraph above and use the experience of Narvik to learn a very important lesson about investing. There is a clear immutable relationship in the investing world: the higher the expected return, the higher the level of risk associated with that return. If you expect to receive outsized returns, be prepared to accept outsized risk. Period. There may have been fraud perpetrated here (and it’s difficult to know without reading the signed agreements), but caveat emptor would have been valid advice in this situation.

What is the general link between subprime mortgages and other collateralized debt obligations (CDOs)–such as auto loans, student loans, and credit card debt–and the international political economy. Is there a general systemic risk to the global economy from new financial instruments, which Warren Buffett has referred to as “financial weapons of mass destruction?” Here is a panel at the 2008 World Economic Forum in Davos, which will shed more light on the financial industry.

Poor Countries, Agriculture, and IMF Policies

There has been a rapid increase in food prices over the last couple of years, seen most dramatically in the recent 30% one-day rise in the price of rice worldwide. This is putting tremendous pressure on the poor and is leading to instability in countries around the world. There have been violent demonstrations–and equally violent government responses–to food rioting in Egypt and Haiti in the last couple of weeks. They may be but a harbinger of the economic and political instability to come. Here is a report from the BBC, in which an expert argues that IMF policies have contributed to the rise in food prices:

“Poor countries need to invest heavily in agriculture to feed their people. There’s been a dearth of investment in agriculture in poor countries, mainly because of IMF and World Bank policies…”

Barack Obama on the Financial System, Uncertainty and Risk

In my post below, I linked to an article by Thomas Homer-Dixon in which, among other things, he argued that the problem with the contemporary financial system is that the arcane machinations and lack of transparency (Level-III assets, anyone?) have transformed the market from one of risk–which can form the basis for a stable financial system–to uncertainty–which cannot. So the question then, is how to create the conditions under which banks and other financial institutions, and investors can adequately assess risk. The lack of transparency is the reason that the credit markets have currently seized up and the Federal Reserve has had to come to the rescue of Bear Stearns. (Ben Bernanke–the Chairman of the Federal Reserve–himself has argued that “banks will fail” over the next couple of years. Indeed, a couple of small regional American banks have already failed.)

By coincidence, Democratic Presidential candidate Barack Obama gave a speech at Cooper Union in New York setting out his vision of how his policies would help the engine of the American (and international) financial system become more transparent and a solid foundation for the US and world economy. I encourage you to watch the speech, wherein Obama presents his view of the nature of the relationship between the market and state (government).

“It’s worth taking a moment to reflect on the role that the market has played in the development of the American story. The great task before our founders was putting into practice the ideal that government could simultaneously serve liberty and advance the common good. For Alexander Hamilton, the young Secretary of the Treasury, that task was bound to the vigor of the American economy. Hamilton had a strong belief in the power of the market, but he balanced that belief with the conviction that human enterprise, ‘may be beneficially stimulated by prudent aids and encouragements on the part of the government [state]'”

Price of Crude Oil Closes above $100/bbl First Time Ever

We’ll be playing the “Oil Game” in class tomorrow in PLSC250. When colleagues of mine used this teaching tool in their classes 4 or 5 years ago, the price of oil was about 1/3 of what it is today. In the clip, Brian Williams will tell you that oil reached a “record” high of $100.01 US a barrel. That’s only true if we’re talking about nominal dollars. In terms of real dollars it still has about 4 USD/bbl to go to hit the all-time high set in December 1979. Hmmm…I wonder what was happening in late 1979? Iran, Afghanistan, plus ca change…

We’ll be playing the “Oil Game” in class tomorrow in PLSC250. When colleagues of mine used this teaching tool in their classes 4 or 5 years ago, the price of oil was about 1/3 of what it is today. In the clip, Brian Williams will tell you that oil reached a “record” high of $100.01 US a barrel. That’s only true if we’re talking about nominal dollars. In terms of real dollars it still has about 4 USD/bbl to go to hit the all-time high set in December 1979. Hmmm…I wonder what was happening in late 1979? Iran, Afghanistan, plus ca change…

Click here to see Maria Bartiromo report from NBC News.

“People are afraid that there is just not enough oil in the world to meet demand; demand which is coming not only from the United States but from emerging economies like China and India.”

Individuals Having an Impact on IR

In a previous post, I asked you to consider not how international relations affects you, but how the way in which you behave, and the actions that you take have an effect on IR. Here’s a story about how changing individual attitudes in Japan may be having a greater impact on the whaling industry than the combined efforts of states and NGOs over the last couple of decades. You can see a graphically disturbing video of whales being killed at the link above.

JAPAN’s whalers are going broke and have been forced to slash prices because no one wants to eat their growing mountain of whale meat.

The farcical truth of Japan’s whaling industry was exposed yesterday by Japanese media reports that the Institute for Cetacean Research is struggling to repay $37 million in government subsidies.

The report came as Japanese embassy officials made a stern protest in Canberra over the Federal Government’s release of shocking whaling photographs.

The ICR, responsible for Japan’s lethal “research operation”, is flooding Japan with cheap whale meat that it cannot sell, according to the reports in respected newspaper Asahi Shimbun.

Meat and other parts of whales killed during ICR “scientific research” in the Southern Ocean is sold to a private fisheries company Kyodo Senpaku, which manages the sale of whale meat in the Japanese market. But while ICR has consistently increased the number of whales it kills – by 30 per cent between 2005 and 2006 – there has been no rise in domestic demand for whale meat or products.

Greenpeace Australia Pacific whales campaign director Rob Nicholl said the losses were further proof that there was no market for whale meat in Japan.

“It’s standard economics. There is an oversupply. They’ve had to reduce the price but they still can’t get rid of the stuff,” he said.

Do you think that this story can shed any light on a potential solution to the drug and human trafficking industries? How specifically?

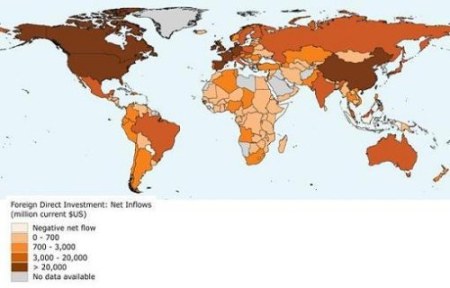

Foreign Direct Investment(FDI)–an Indicator of Globalization

As we will see, globalization is a word (and phenomenon) that is analogous to a Rorschach test in that everyone seems to have his, or her, own slightly unique definition of what it actually means. There is wide agreement, however, that an important characteristic of contemporary globalization is the level of economic integration internationally. One such component of that integration is foreign direct investment (FDI). From the World Resources Institute, here is a map that shows the differing levels of FDI around the globe. The patterns should, by now, be exceedingly familiar.

Here is the map description:

Foreign direct investment data do not give a complete picture of international investment in an economy. Balance of payments data on foreign direct investment do not include capital raised locally, which has become an important source of financing for investment projects in some developing countries. In addition, foreign direct investment data capture only cross-border investment flows involving equity participation and thus omit nonequity cross-border transactions such as intrafirm flows of goods and services. For a detailed discussion of the data issues see the World Bank’s World Debt Tables 1993-1994 (volume 1, chapter 3). Also, cross-country comparisons may not be accurate, because of differences in the definition of what constitutes foreign direct investment.

Source: World Bank Group. 2004, World Development Indicators Online. Washington, DC:World Bank.

Available On-line at: Source Link

A Unique Indicator of Economic Development–Luminous Flux

Or light. Below you will find a fascinating map from the World Resources Institute, (which is a great website, featuring information on such matters as renewable fresh water resources, literacy rates, and other phenomena that are found at the “intersection of the environment and human needs.”

Here is a description of the map:

“The National Geophysical “city lights” database depicts stable lights and radiance calibrated lights of the world (which includes lights from cities, towns, industrial sites, gas flares, fires, and lightning illuminated clouds). A high concentration of city lights is especially found in industrialized densely populated regions such as western Europe, Japan, and the U.S.. Alternatively, few “city lights” are shown in economically poorer and sparsely populated regions (e.g. central and northern Africa and South America). Moderate “city lights” are found in several densely populated “developing countries” (e.g. India, Indonesia, eastern Brazil, and South Africa). The “city lights” data may be used a proxy for population distribution or infrastructure (e.g. in which it may be assumed that the occurrence of few city lights is correlated with the presence of institutional, political, and industrial infrastructure).”

Afrobarometer Public Opinion Surveys

The Afrobarometer survey allows public access to its data, with a two-year time lag. From a description found on its home page, the Afrobarometer is “a comparative series of public attitude surveys on democracy, markets, and civil society in Africe.” The site is full of resources, in addition to the data, such as publications (including downloadable working papers), results, news and events.

Here are the countries surveyed and the years for each:

|

Country

|

Round 1

|

Round 2

|

Round 3

|

Other

|

| Benin |

—

|

—

|

2005

|

—

|

| Botswana |

1999

|

2003

|

2005

|

—

|

| Cape Verde |

—

|

2002

|

2005

|

—

|

| Ghana |

1999

|

2002

|

2005

|

1997

|

| Kenya |

—

|

2003

|

2005

|

—

|

| Lesotho |

2000

|

2003

|

2005

|

—

|

| Madagascar |

—

|

—

|

2005

|

—

|

| Malawi |

1999

|

2003

|

2005

|

—

|

| Mali |

2001

|

2002

|

2005

|

—

|

| Mozambique |

—

|

2002

|

2005

|

—

|

| Namibia |

1999

|

2003

|

2006

|

2002

|

| Nigeria |

2000

|

2003

|

2005

|

2001, 2007

|

| Senegal |

—

|

2002

|

2005

|

—

|

| South Africa |

2000

|

2002

|

2006

|

1994, 1995, 1997, 1998, 2004

|

| Tanzania |

2001

|

2003

|

2005

|

—

|

| Uganda |

2000

|

2002

|

2005

|

—

|

| Zambia |

1999

|

2003

|

2005

|

1993, 1996

|

| Zimbabwe |

1999

|

2004

|

2005

|

—

|

You must be logged in to post a comment.